MDR/IVDR Survey: Most Manufacturers Ready To Yank Some Legacy Products From EU Market; Hiring Up At Firms

Executive Summary

The impending implementation of the EU's new Medical Device and IVD Regulations will cause most firms to pull select legacy devices and in vitro diagnostics from the EU market, a survey of 169 quality and/or regulatory professionals finds. The survey also revealed that companies are in hiring mode as the compliance dates for both regulations approach. Quality and regulatory officials from Abbott Laboratories and Meridian Bioscience weigh in.

Most manufacturers plan to stop selling at least one legacy product in the European Union after the EU's new Medical Device and IVD Regulations go into effect, a recent industry survey finds.

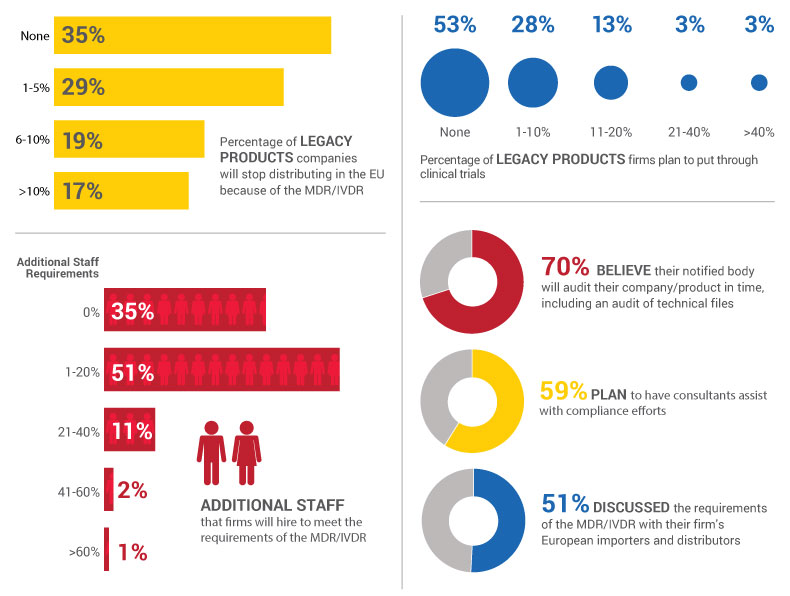

The survey of 169 people who work in quality and/or regulatory roles in medical device and IVD firms showed that 107 respondents – 65% – said the impending implementation of the MDR/IVDR will be the impetus for pulling select legacy devices and in vitro diagnostics from the market. (See infographic below.)

Legacy products are products that are made and sold under the EU's current directives (the Medical Device Directive, the Active Implantable Medical Device Directive and the IVD Directive); they must comply with the MDR/IVDR in 2020 and 2022, respectively. (Check out Medtech Insight's interactive timeline for worldwide regulatory deadlines here.)

Manufacturers will have four years after the MDR/IVDR implementation dates to ensure the products' compliance, otherwise they'll be yanked from shelves. (Also see "EU MDR Compliance Isn't Automatic For Legacy Devices, So Plan Ahead, Says RAPS Director" - Medtech Insight, 5 Jun, 2017.)

"There’s going to be a number of products we’re just going to have to walk away from [in] that marketplace, just because it’s going to cost us more to keep it in Europe," Meridian Bioscience's Susan Rolih says.

Outcomes from the anonymous, unscientific questionnaire serve as a general bellwether of MDR/IVDR trends at firms. The survey, conducted in March and April, was coordinated by Cincinnati's Xavier University, Compliance-Alliance, FOI Services, and the George Washington University School of Medicine and Health Sciences.

The MDR/IVDR calls for companies to update clinical data, labeling and technical documentation for legacy products, and firms must review risk management and quality assurance activities related to those products, among other tasks.

For many firms, it's not worth the added investment in time and money to bring older products up-to-date with the MDR/IVDR. The recent survey indicated that more than half of firms – 53% – don't plan to put legacy products through new clinical trials to conform to the regulations.

Susan Rolih, executive VP of regulatory and quality systems for Meridian Bioscience Inc., said her firm will probably stop selling "a number of products" in the EU because it will simply be too costly – although she declined to speculate on the percentage of products that Meridian will remove from the market.

"Because we’re an IVD company, we have a lot of products that are for smaller, niche markets – very small volume. Some of [the products] have been around since the late '70s to early ‘80s, where, even if they’re [US] FDA-cleared, there wasn’t a lot of burden of proof as far as the clinical trials were concerned," Rolih said May 4 at MedCon 2018 in Cincinnati, where the survey results were presented.

Meridian is a manufacturer of products such as the illumigene molecular diagnostic system and the TRU Legioniella rapid assay.

Rolih said her firm is "going back through our entire product line and looking at whether we need to do clinical trials [and what the cost will be] of supporting that product."

When the costs of complying with the IVDR are compared to the total annual sales for certain products, it simply doesn't make sense to continue selling them in the EU, she said.

"There’s going to be a number of products we’re just going to have to walk away from [in] that marketplace, just because it’s going to cost us more to keep it in Europe," Rolih said.

Abbott Labs will likely pull 1% to 5% of its products from the EU market, company quality VP Monica Wilkins says.

Also at MedCon, Monica Wilkins, divisional VP of medical, quality and strategic support for device-maker Abbott Laboratories Inc., said the giant firm would not sell a small portion of its products in the EU after the new regulations go into effect.

"We definitely will have some [products that Abbott will take off the market in the EU], just by the nature of the volume we sell, and because some are much older products," Wilkins said.

She estimated that between 1% and 5% of the company's product portfolio won't be sold in the EU after the regulatory change, putting Abbott in the same boat as 29% of respondents to the industry survey.

In a December interview with Medtech Insight, veteran medtech regulatory expert Jaap Laufer said he was concerned about the fate of legacy products. (Also see "MDR And IVDR Fail Risk-Benefit Assessment, EU Reg Expert Says" - Medtech Insight, 14 Dec, 2017.)

He surmised that "legacy products, those that have been on the market for decades without problems, will be the first to disappear as manufacturers cannot invest substantial amounts for these mostly very moderately priced devices," Laufer, who is VP of regulatory and clinical affairs for consulting firm Emergo Group, said at the time.

"I can see essential surgeries and other interventions being cancelled because of this," he added.

EU MDR/IVDR: Good For The Job Market

The recent survey also revealed that 65% of firms are hiring at least one new worker to help with the transition to the new regulations.

Meridian's Rolih said her firm has hired about 20% more staff; a majority of survey respondents – 51% – said they too would increase their staff by 1% to 20%.

"We’re approximately right now at the 20% mark, and we have probably about 175 products, only one of which has a CE certificate right now. So, we have to virtually take our whole product line into this new process; [that's why] we started beating this drum two years ago," she said.

Rolih stressed that quality and regulatory professionals should communicate to top management the importance of investing in handling the regulatory change.

"Present the financials to your executives [showing] what happens if you don’t put in the resources now," she said. "You can’t afford to walk away with 175 products out of Europe and survive as a company."

That Meridian and Abbott are using consultants shouldn't be a surprise given that 59% of survey respondents said they're doing the same.

Abbott's Wilkins, who said her company will expand staff size by 1% to 20%, is also using industry consultants to help navigate the MDR/IVDR waters.

"The majority of our units are going to use consultants – some will not – but overall we will," Wilkins said. "Typically, we utilize consultants throughout for a different variety of things, so quite a few consultants are already familiar with our products," which gives them a leg up.

Rolih said her firm is also using consultants. "Our consultants are based on their knowledge of our product type and having familiarity with applications of our product types," she said. "When it comes to people who retired from your organization – this is a good time to bring them back" to consult, if possible.

That Meridian and Abbott are using consultants shouldn't be a surprise given that 59% of survey respondents said they planned to do the same.

Firms Confident Audits Will Happen On Time

Meanwhile, most survey respondents – 70% – fully expect their notified bodies to audit their facilities before MDR/IVDR implementation, including an audit of technical files.

But Meridian's Rolih stressed that technical file audits might not happen in time if a manufacturer doesn't plan.

"It’s human nature to procrastinate. Every other company in the world’s going to wait until the last year to get their documents in, and you can’t do that," she said. "Start your communications right now with your notified body as to how they want to get those documents, how soon they want them, how they want them packaged, and you get on this early. The earlier you get things in, the better off you’re going to be."

Importers And Distributors Likely On The Ball

And 51% of firms have already discussed MDR/IVDR requirements with importers and distributors, the survey showed.

Gert Bos, executive director and partner at Qserve Group, said manufacturers should feel rest-assured knowing that European importers and distributors are likely on the ball when it comes to the new regulations.

"Your importers and distributors are very knowledgeable. They know about this legislation and the new rules, so they will contact you. So, I would say you don't have to worry," Bos said at MedCon.

Nevertheless, "the most critical element is your European importers and your European authorized representatives," he said. "Whether they are inside your company, or whether they're external companies, they will have liability. They will have responsibility."

From the editors of The Gray Sheet