‘Femtech’ Evolving Beyond Periods, Pregnancy And Postpartum: What’s Next In $1.2Tr Women’s Health

Medtech Insight spoke with three female femtech visionaries about the biggest funding opportunities, clinical needs, and what it will take to put women’s health squarely on the global map.

Executive Summary

Digital female-centric primary and preventive care and fertility support were top-funded women’s health segments in 2021, drawing $668m and $330m in investments, respectively. Going forward, experts anticipate innovation to address unmet needs related to menopause, vaginal microbiome, endometriosis, and other chronic conditions, and surgeries such as hysterectomies and mastectomies.

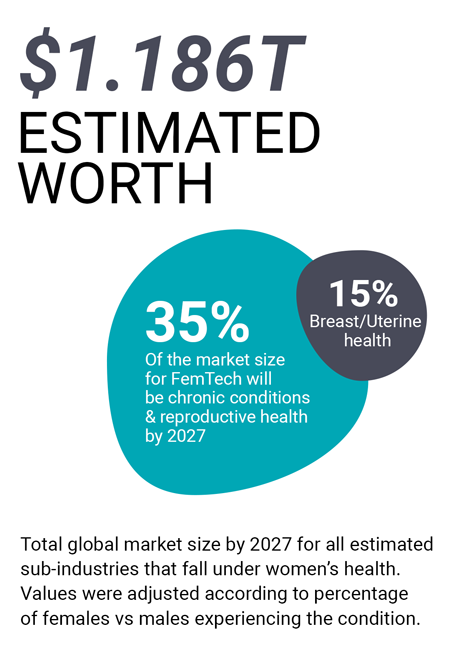

“Femtech” companies will branch in new directions in the coming years to address unmet needs and distance themselves from the competition in a women’s health market expected to reach a whopping $1.19tr by 2027.

FemTech Focus, Coyote Ventures

FemTech Focus, Coyote Ventures

That is the eyepopping figure reached in a Femtech Landscape Report 2021 co-authored by nonprofit FemTech Focus and Coyote Ventures, which invests in early-stage start-ups innovating in women’s health and wellness. (Also see "Femtech Presents Enticing Market Opportunity" - In Vivo, 5 Oct, 2020.)

Coyote Ventures and FemTech Focus define Femtech as "technology that improves women, female and girls’ health and wellness by addressing conditions that solely, disproportionately, or differently affect them” including medical devices, software, therapeutic drugs, consumer products and services, and apps. The term FemTech was coined by Ida Tin, founder of period tracker app Clue. (Also see "Market Intel: Let's Talk About It — The Rising Tide Of 'Femtech' Companies " - Medtech Insight, 12 Feb, 2019.)

Brittany Barreto, a geneticist by training, co-founded Coyote Ventures with another “scientist turned entrepreneur turned investor,” Jessica Karr, after launching FemTech Focus in 2020 during the early COVID lockdowns.

The nonprofit’s aim is to boost awareness of women’s health issues and systemic inequities, targeting a FemTech podcast, virtual events and market research to key stakeholders such as investors, entrepreneurs, governments, and hospitals. The group notes that “only 4% of all health care research is dedicated to women’s health. Many diseases, such as endometriosis, were classified as hysteria up until recently. In 2019, less than 1% of venture capital was invested in women’s health companies.”

Today, the landscape is rapidly changing. In an interview with Medtech Insight, Barreto notes that FemTech Focus and its network of connections have provided a deeper understanding of the market’s scope, including budding investment opportunities. (Also see "Direct To Consumer Approach Underscores Femtech’s Disruptive Potential" - In Vivo, 10 Feb, 2021.)

“Now I had the ear of everyone in women’s health, because my podcast has 45,000 listeners, and the respect of the industry because we published that report showing that the market size is $1.19 trillion. We have the largest database of femtech start-ups and femtech exits, so it really positioned ourselves well to launch a fund,” Barreto said.

![]() FemTech Focus, Coyote Ventures

FemTech Focus, Coyote Ventures

The group’s database keeps growing every month with 921 companies now listed, up from 657 in the report. It segments femtech by product type, such as consumer packaged goods, or by health topic.

BRITTANY BARRETO, CO-FOUNDER COYOTE VENTURES, FOUNDER FEMTECH FOCUS

BRITTANY BARRETO

BRITTANY BARRETO, CO-FOUNDER COYOTE VENTURES, FOUNDER FEMTECH FOCUS

BRITTANY BARRETO

FemTech Focus also has acquainted women’s health companies with each other, which should help to sharpen competitive strategies and drive innovation in new areas, Barreto suggests.

“They will probably be the biggest pods of companies for a few more decades, but there are less companies forming in menstruation, breast health, fertility, because what’s happening is we’re having more transparency inside femtech,” she said. “One of my goals with FemTech Focus was not only to create external awareness of what Femtech is, but also internally, because we had an issue with a lot of companies working on the same solution because they didn’t know about each other.”

She pointed to the oversaturated market for sanitary pads and tampons, which is also unsustainable with 20 billion menstrual products being sent to landfills in North America every year.

“We’re still diagnosing endometriosis like we did in 1909.” – Jane van Dis

Global funding to female-founded companies dropped significantly in 2020 to about 2.3% of invested dollars, according to Crunchbase. Barreto ranks among leading female voices that believe underinvestment in femtech can be attributed to lack of understanding of women’s health issues by male investors. Femtech company leaders also report that investors can be uncomfortable with the subject matter.

That said, US start-ups providing digital solutions for women’s health raised $1.3bn through 31 August 2021, nearly doubling all of 2020’s $774m, according to a report from digital health venture company Rock Health. While 2021 boasted the most funding ever recorded in the space, Rock Health noted that it still only makes up 5% of overall digital health funding since the firm started tracking the market in 2011. (Also see "Rock Health Reports Record Digital Health Funding Of $5.4Bn In H1 2020, Sees Potential For Record-Year Funding" - Medtech Insight, 15 Jul, 2020.)

Rising Opportunities

According to the Femtech Focus report, the most common product type in femtech is in consumer product goods with menstrual hygiene and sexual wellness products accounting for 38% and 18% respectively.

Coyote Ventures’ database lists the most common subsections of female health addressed by companies as menstruation (100 companies), maternal health (98), fertility (81) and sexual wellness (57), together accounting for 51% of the total start-up landscape.

Rock Health says digital apps to support women through pregnancy, postpartum and parenthood accounted for 37% of women’s health companies founded in the past five years. Half of digital women’s health companies that exited via an acquisition or public markets are in those categories, including such names as Lucina Health, OBMedical Co., Ovia Health, PeriGen Inc. and Sense4Baby Inc.

However, with less than 45% of the US female population at reproductive age, and the US birth rate at its lowest to date, it could behoove companies to strike out in new directions, Rock Health suggests.

That seems to be happening. Rock Health reports that last year, the top-funded women’s digital health segment was primary and preventive care with $668m, followed by fertility support at $330m and pregnancy, postpartum and parenthood at $316m, driven by four mega deals from Ro, LetsGetChecked, TMRW Life Sciences Inc. and Maven Biotechnologies LLC.

Barreto expects the innovation pipeline will change by 2027 to close gaps in women’s health needs. In five years, chronic conditions and reproductive health are projected to make up 35% of the femtech market and breast and uterine health 15% of the market.

The investor predicts that more companies will be targeting perimenopause/menopause and behavioral health down the line. According to statistics published by the Female Founders Fund, the menopause market alone could reach $600bn by 2027.

According to Pubmed, 1.2 billion women globally will be in or approaching menopause by 2030, with 47 million new entrants each year.

Rock Health notes that funding into the perimenopause and menopausal sector doubled from $37m in 2019 to $79m through August of 2021. Key players in digital menopause care include virtual coaching services Elektra Health, Gennev and Evernow and digital pharmacy support from Rory.

In July 2021, mental health platform Happify Health launched the app Kopa to support women navigating midlife health needs. (Also see "Happify Health Launches Prescription Digital Therapeutics To Treat Depression Or Anxiety" - Medtech Insight, 23 Jul, 2021.)

Rock Health also sees digital health taking on other conditions stigmatized in the past – including sexually transmitted infections and pelvic floor disorders – and identifies significant gaps in care around health needs related to miscarriage, abortion, and surgeries such as hysterectomies and mastectomies.

Companies such as Brilliantly, which creates wearables and exercise plans for women undergoing mastectomies, Hey Jane, a virtual clinic for abortion care, and Pregnancy After Loss, an app that helps navigate conception after a miscarriage, are paving the way, the authors say.

Clinical Needs

According to Jane van Dis, an obstetrician-gynecologist and assistant professor at the University of Rochester, one of the biggest clinical opportunities where there is a tremendous unmet clinical need is endometriosis.

One in 10 women of reproductive age is estimated to suffer from the chronic systemic disease, which can cause debilitating pain and infertility. The underlying pathophysiology remains poorly understood and diagnosis can take years.

“We’re still diagnosing endometriosis like we did in 1909,” van Dis told Medtech Insight.

Currently available medications are associated with high bone mineral density loss and menopause-like symptoms. Laparoscopy is the only way to conclusively diagnose endometriosis, but is an invasive and imprecise procedure that carries risk and is also very costly.

The certain treatment is to remove the uterus, van Dis explains, but “the problem is that even after we’ve removed the uterus, some women still have chronic pelvis pain.”

“We’ve known about the disease for decades, but we are still unable to tell our medical students and our residents how and why this disease happens. That is a failure of the patriarchy which determines where funding goes in the medical research and a lack of support for women’s health,” she says.

Van Dis is often at the forefront of innovation. She was the former medical director of the Maven Clinic, a telemedicine company that became the first unicorn in the women’s and family health sector, and is a leading advisor to women’s health venture fund Portfolia.

Coyote Ventures funneled $100,000 in seed money to San Antonio, Tx-based start-up Hera Biotech, which is working on a diagnostic for endometriosis. Hera Biotech says on its website its initial pathway for commercialization will be to develop MetriDx as a laboratory-developed test, following the necessary validation studies and obtaining Proprietary Laboratory Analyses Code for reimbursement. The test is designed to have patient’s endometrial cells collected via an in-office, minimally invasive procedure that eliminates the need for a surgical biopsy.

Van Dis says vaginal microbiome is another big clinical opportunity.

She notes, “There are so many disease processes, and we know that the immune system is innately tied to the intestinal microbiome.” There are effective tests for specific diseases such as chlamydia, gonorrhea, trichomoniasis and bacterial vaginosis, but there is still much to be discovered, she said.

Van Dis also believes current therapeutics for treating vaginal diseases are inadequate.

Barreto is watching for device innovation that can help “cross the cervical barrier,” for example in placement of IUDs, which is often very painful.

“I’m interested in devices that are not necessarily changing the game procedure-wise … but how can we make these procedures less painful and so easy that your general practitioner can do it rather than a specialist,” she said.

Behavioral Health

Despite an overall surge in behavioral health funding, driven in great part by the pandemic, only 4% of that funding in 2021 went to companies that offer specific solutions for women related to anxiety, depression, postpartum mental health, substance use disorder, and other behavioral health conditions, Rock Health says.

Similar demand exists for chronic disease care, for women with cancer or heart disease for example, according to the firm’s report.

According to the FemTech Landscape report, chronic conditions will dominate the landscape for women’s health by 2027, representing a $218bn market, followed by reproductive health in second place with $171bn and breast health in third place with $99bn.

Van Dis advises start-ups to make sure they have a solid medical team.

“I feel like there’s a lot of people out there who want to make money in this space, but who think they can cut corners when it comes to the clinical relevance of whatever the product is. … You want to hire a medical expert who will push back if you suggest something that either is not a good source of resources or potentially has the ability to cause harm.”

Maneesha Ghiya, founder of Femhealth Ventures

Femhealth Ventures

Maneesha Ghiya, founder of Femhealth Ventures

Femhealth Ventures

Maneesha Ghiya, founder and managing partner at FemHealth Ventures, also is riding the femtech wave, focused on supporting diagnostics, software, devices and digital apps geared toward improving women’s health.

Ghiya started the fund in 2019, but its inspiration traces back to major complications she suffered during childbirth more than a decade ago.

“I had internal bleeding that was missed, followed up by an emergency C-section, followed up by an operation to find the source of the internal bleeding, which they couldn’t find, and I went into a condition called DIC, which is basically ‘death is coming,’” Ghiya recounts in an interview.

She considers herself very fortunate now to have a healthy 13-year-old daughter, but says the experience left her traumatized.

“We really want to look at the whole woman and how we can improve care for women [with a focus] on bringing existing technologies to new applications in women’s health,” she said. FemHealth Ventures’ portfolio companies include BioAesthetics, which develops a nipple-areolar complex graft to provide women who have had mastectomies with a new living nipple, and Raydiant Oximetry, Inc., which is developing a fetal monitoring technology.

Well-publicized 2021 late-stage investments in women’s health include Carrot Fertility, a complete fertility solution for employers and payers, which raised $75m. Tia, which combines in-person and virtual care for women, raised $100m, and Maven, a virtual care model built around women and families pulled in $110m.

Rock Health notes that 69% of women’s health companies that raised capital from January through August 2021 are led by women CEOs compared with 20% of all digital health companies funded in the same period.

“We have a fantastic health care system, but still there’s so much more that could be done,” Ghiya said.