Optimizing Product Lifecycle Management With Real-World Evidence

Executive Summary

An increasingly data-rich healthcare sector presents both opportunities and challenges for the MedTech industry, just as it does for the health systems and patients served by MedTech products.

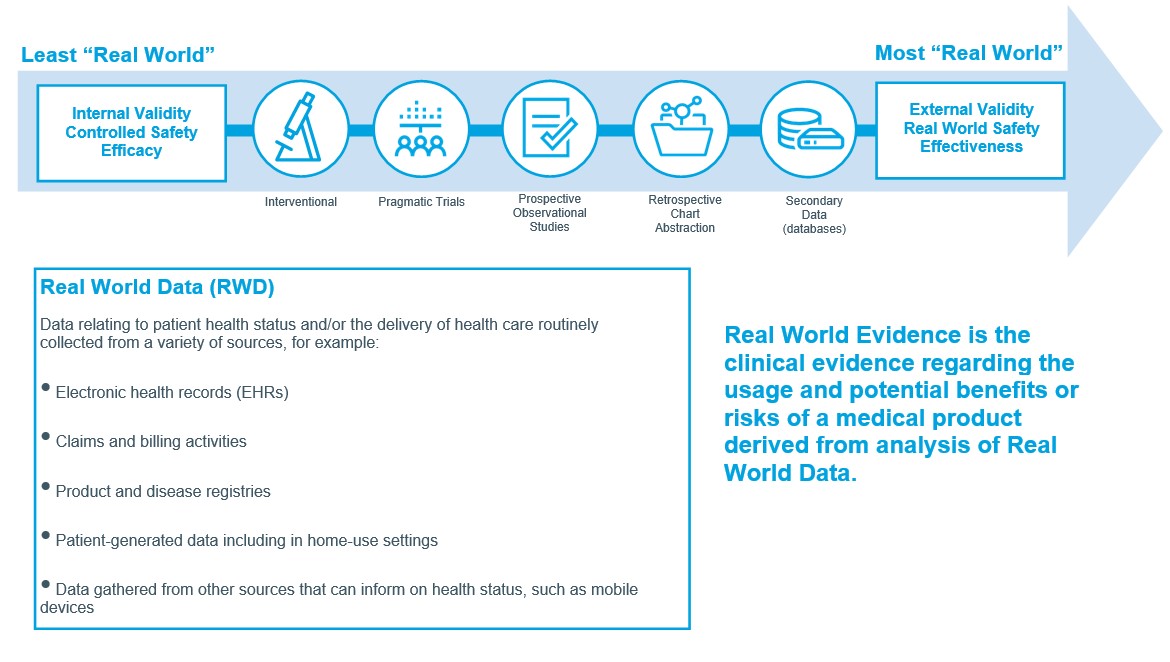

Used intelligently and appropriately, the vast quantities of real-world data emanating from multiple healthcare sources, such as electronic medical records (EMRs), claims databases, products and disease registries, provide the raw material for real-world evidence (RWE) that can inform strategy and decision-making throughout the MedTech-product lifecycle.

“What we’re seeing in the industry today is a shift towards the use of real-world data to generate real-world evidence,” notes Michelle Bulliard, IQVIA MedTech Real World Solutions global leader.

Historically, randomized controlled trials (RCTs) were the gold standard in the hierarchy of evidence for demonstrating the safety and effectiveness of MedTech products. However, RCTs rely on carefully managed product use in stable, homogeneous patient populations. “You have to enroll a controlled population, so you know that you’re measuring the effect of the product,” Bulliard explains. “You can’t have any noise around it.”

That leaves an evidence gap between clinical development and the real world. In the real-world setting, patients tend to be far more diversified, may have co-mordibities, or may be using other products that interact or interfere with the device of interest. And RCTs, with their tightly controlled conditions, often do not accurately reflect patterns of real-world product adoption by surgeons or patients themselves.

“We’re seeing now that randomized controlled trials don’t answer all of the questions in terms of the populations that are going to be using a device,” Bulliard comments.

MedTech companies can help to fill this gap by gathering real-world data systematically on actual, ongoing product use and outcomes, then sifting and analyzing this data to generate real-world evidence of the associated benefits and risks (see Figure 1).

In a digital age in which MedTech products, prescribers and users are increasingly networked, Real World Data can be leveraged both from existing data sources, such as electronic medical records, medical-claims databases, integrated data networks, social media and wearable devices; or prospectively through channels such as dedicated disease registries, observational studies or pragmatic clinical trials.

Figure 1: Defining Real World Evidence

https://www.fda.gov/scienceresearch/specialtopics/realworldevidence/default.htm

Drivers For Real World Evidence

There are a number of drivers boosting the flow of Real World Evidence in MedTech, both pre-approval and throughout the product lifecycle. One is the changing regulatory environment reflected in recent developments such as the EU’s new Medical Device and In Vitro Diagnostic Regulations, or FDA moves to incorporate Real World Evidence more substantially into regulatory decision-making for devices.

The European Union’s Medical Devices Regulation (MDR, 2017/745/EU) and its In Vitro Diagnostic Regulation (IVDR, 2017/746/EU) were published in May 2017, with a transition period for implementation ending on 26 May 2020 for medical devices and 26 May 2022 for in-vitro diagnostic devices.

Together with more stringent requirements for Notified Bodies and device certification, the Medical Device Regulation places more emphasis on a lifecycle approach to safety, backed up by clinical data, than the Medical Devices Directives it replaces. For its part, the IVDR includes tougher standards for clinical evidence and conformity assessment, so that around 85% of all in-vitro devices will now come under the oversight of Notified Bodies.

In broad terms, these changes will mean more clinical-data collection and reporting to certify or recertify most devices, as well as more post-marketing surveillance and in most cases ongoing performance evaluation. Any or all of these requirements can be eased through astute use of real-world data and Real World Evidence, whether to enrich clinical data for (re)certification or to inform performance evaluations throughout the product lifecycle.

The US Food and Drug Administration issued final guidance for industry and FDA staff on Use of Real-World Evidence to Support Regulatory Decision-Making for Medical Devices in 2017. The guidance states that under “the right conditions”, data derived from real-world sources “can be used to support regulatory decisions”, while real-world data and Real World Evidence “may constitute valid scientific evidence depending on the characteristics of the data”.

It also notes how real-world data sources, such as registries, electronic health records or administrative and healthcare claims databases, “can be used as data collection and analysis infrastructure to support many types of trial designs, including, but not limited to, randomized trials, such as large simple trials, pragmatic clinical trials, and observational studies (prospective and/or retrospective)”.

The document further addresses the potential of Real World Evidence to inform and monitor off-label use of devices in routine clinical practice. The knowledge gained from these uses is “often not realized because the data collected are not systematically characterized, aggregated, and analyzed in a way that can be relied upon to inform regulatory decision-making”, the FDA points out.

Shifting Demographics

Another driver for Real World Evidence is shifting demographics. With populations aging worldwide, MedTech products must address a broader range of treatment needs and chronic diseases over extended lifespans, while carefully tracking long-term health outcomes.

In parallel, access to medical devices is improving in less-developed markets such as the Asia Pacific region, where growth in MedTech product uptake is expected shortly to overtake that in Europe.

Increasing product complexity and sophistication are also factors in raising the profile of Real World Evidence within the MedTech industry. Not only do more advanced products demand closer attention to real-world outcomes, but the evolution of digitally connected devices means that patients’ health status can be monitored more effectively in real time.

“Patients now can be followed up and treated from their home setting,” Bulliard observes. “Especially when you have digitally connected devices, the physician can get downloads and alerts each day. For example, where a patient is using an insulin pump, the physician will know if they have hypoglycemia or have increased their dose.”

Earlier Application

Real World Evidence was initially viewed largely as a source of post-marketing safety and effectiveness information for MedTech. “That could be to meet a regulatory commitment or a safety commitment, looking at longitudinal follow-up,” Bulliard adds.

“It could be to differentiate the device in a crowded marketplace, to help with market access or health economic and outcomes research. That’s traditionally how we see real-world evidence being collected and used.”

Now there is growing recognition of Real World Evidence value as a tool for product development and regulatory support from the earlier stages of lifecycle management. This is especially pertinent in the MedTech sector where budgets for R&D and medical affairs are shrinking, and where faster approvals and continual upgrades make for shorter product lifecycles than in the pharmaceutical industry.

The trend also has global ramifications, as part of an evolving ‘MedTech ecosystem’ characterized by more collaboration, transparency and acceptance of regulatory data across geographical regions.

Identifying Patient Needs

One way in which Real World Evidence supports more effective and cost-effective MedTech-product development is by identifying unmet patient needs to underpin better protocol designs and study endpoints in clinical trials. “We can look at existing data sources to map the patient journey: how often they’re going to their physician, how often they’re using treatments,” Bulliard explains.

Patient needs are just one element of a multi-stakeholder environment in which Real World Evidence helps MedTech companies to plan for market entry and product uptake. Building disease registries pre-market as historical control arms is another way of enriching data packages and delivering smarter studies for regulatory approvals.

Once a product is in the marketplace, Real World Evidence can enhance commercial performance and product value – for example, by helping to illuminate a device’s benefits and risks in actual clinical practice to support label expansion or validation of off-label use.

Demand For Value

Real World Evidence generation is also a response to growing demand from physicians, surgeons, healthcare payors, health technology assessors and other stakeholders for evidence of long-term value and cost-effectiveness, as well sustained product efficacy and safety, throughout the lifecycle.

Health-technology assessors are asking for patient-reported outcomes in the real world as part of the cost-benefit proposition for new devices. Patients too are looking for real-world evidence to tell them which device is the safest and most effective for their particular needs, or which will provide the best outcomes without too much disruption to their lifestyle.

This calls for earlier engagement by industry in generating Real World Evidence to support both regulatory decision-making and market access. MedTech companies are turning increasingly to outsourced providers in this respect, as the companies “don’t always have enough capacity, resources or talent to conduct these studies globally”, Bulliard comments.

Market-access barriers for MedTech products are even higher now than for pharmaceuticals, with particularly complex tender processes for hospital listing. “Tenders are opened up every few years and they’re very, very competitive,” Bulliard notes.

Where a medical device is linked to a surgical procedure, such as implantation of a cardiac valve, payers want to know whether the whole procedure will produce better health outcomes, and across the whole patient journey. With modern implants, that may mean tracking outcomes for 15-20 years.

Real World Evidence Challenges

While the sources of Real World Data and Real World Evidence to inform product lifecycle management have proliferated with the explosion of digital technology, they have also created a number of challenges, particularly around the quality, consistency and completeness of secondary data.

There is a growing need for standardization of data collection, common terminology, and quality control at the point of care. Data privacy/anonymity and explicit patient consent to data use must be handled carefully, especially with implementation of the General Data Protection Regulation in the European Union.

“In Europe it’s more challenging, because we’re dealing with all the different country regulations and systems, as well as the more complex data-privacy legislation,” Bulliard points out.

Looking to Specialists

All of this explains why MedTech companies are looking to specialist providers such as IQVIA to help them navigate the opportunities and pitfalls of generating and leveraging Real World Evidence in product-lifecycle management.

IQVIA’s own global data portfolio includes more than 530 million non-identified patient records across 100-plus markets, drawing on over 3,000 dynamic sources ranging from electronic medical records, hospital, pharmacy and claims data, through to genomics, mobile-health outputs and patient-reported outcomes.

The transition from Real World Data to Real World Evidence calls for advanced analytical methods and expertise across disciplines such as epidemiology, biostatistics and data management, to ensure that real-world data are properly cleaned, graded and contextualized into meaningful real-world evidence that addresses multi-stakeholder needs.

For industry, the time to address these issues is now. Real World Evidence used to be a "nice-to-have" for MedTech. Nowadays, with the strategic challenges of the regulatory environment, pricing pressures on devices, tougher conditions for reimbursement and market access, and increased competition in the marketplace, it is a "must-have" for sustained, effective and innovative product-lifecycle management.