Market Intel: Can New Wave Of Tests Finally Nail Early Diagnosis Of Lung Cancer?

Executive Summary

Early diagnosis of lung cancer continues to be a major clinical challenge and the opportunity for products that can successfully detect the disease early enough to boost survival rate is huge. This article looks into the market potential and highlights companies developing technologies that they believe can finally turn this deadliest of cancers on its head.

The five-year survival rate for lung cancer remains a dismal 17.7%, a rate that improved only by a few percentage points since the 1970s, largely because most cases are still diagnosed in late stages. The disease is also common, being the second-most frequently diagnosed cancer in the US and the most diagnosed kind in China, where smoking is on the rise among young adults.

Catching lung cancer early is paramount to improving the survival rate and reducing treatment costs. Early-stage lung cancer, often picked up as an “incidentaloma” on CT scans ordered for other reasons, has a five-year survival rate of 55%, compared with only 4% at stage 4.

While many liquid-biopsy companies offer approaches to treatment selection and prognostication for diagnosed lung cancer, other device companies are honing in on the early diagnostic space for this disease, where they see two important unmet needs.

The first, quite simply, is early detection. The current gold standard is low-dose CT scanning (LDCT) in high-risk populations, a strategy that gathered momentum after a landmark 2011 study appeared in the New England Journal of Medicine. The National Lung Screening Trial (NLST) demonstrated a 20% mortality reduction in lung cancer with LDCT screening programs for patients aged 55 to 80 with a history of 30 pack-years of smoking or more who are either current smokers or who quit 15 years ago or less. Some nine million people in the US are eligible for screening based on the NLST criteria.

There are drawbacks to LDCT, including cost, risk of radiation, and false positives. Most countries outside the US can’t afford to institute widespread CT screening, and many centers in the US do not yet follow guidelines. Moreover, over half of lung cancers still occur in people who don’t meet strict LDCT screening criteria. “Even if 100% of the people who met that criteria actually went and got screened, they’d still miss the majority of lung cancers,” says Barry Cohen, director of sales at [Genesys Biolabs], which markets an early-detection blood immunoassay.

Lung Nodule Headaches

Another drawback, one that causes a second major unmet need, is the indeterminate nodule. While many nodules found on CT, either incidentally or through a screening program, can be categorized as high- or low-risk (based in part on size and patient risk factors), leading to straightforward next steps, others fall into a gray area. These indeterminate nodules present physicians with difficult choices: should they recommend invasive and risky operations? Despite best efforts, about one-third of lung nodule surgeries turn out to be negative for cancer. Should they use bronchoscopy, PET scans, fine needle aspiration? Should they do expensive and irradiating watch-and-wait repeat CTs?

This clinical problem arises all the time. A study published in November 2015 in the American Journal of Respiratory and Critical Care Medicine estimated 1.5 million nodules are found each year, a tenfold increase from earlier estimates. Integrated Diagnostics Inc. CEO Albert Luderer cites company research that estimates three million pulmonary nodules will be found in the US every year—half are found once lung cancer screening with low-dose CT is fully implemented, and half as “incidentalomas” from a scan ordered for another reason. Many of those nodules are indeterminate. The right test to sort them out could greatly improve patient care.

“If you can reduce the number of folks that don’t need to go into either a wedge biopsy or a needle biopsy, you’re going to have huge cost savings and huge patient benefit,” Luderer says.

Market Size

Market-size numbers for this niche within lung cancer diagnostics are hard to come by. Mike Nall, CEO of liquid-biopsy company Biocept Inc. cites estimates of $10bn-20bn for cancer diagnostics worldwide. Today, many of those tests are for liquid biopsies engaged in tumor profiling and monitoring for patients with diagnosed lung cancer.

Still, available numbers regarding early detection and nodule management are impressive. The UK National Health Service estimates a savings of £245m if 10,000 lives can be saved by 2020 with early detection, a goal it’s pursuing through a large study of Owlstone Medical’s early-detection breath test. Oncimmune Ltd. estimates $590m in worldwide sales in 2021 of its autoantibody early-detection test, while Veracyte Inc. calculates its own US opportunity alone to be $525m for its epithelial-genome test in the setting of indeterminate nodules.

“This is one of the few blockbuster markets that are out there in diagnostic medicine. Assuming $3,000 per test for three quarters of a million indeterminate nodules per year, it is potentially a $2bn market in the US." - Albert Luderer, Integrated Diagnostics, Inc.

Integrated Diagnostics, which uses mass spectrometry in its indeterminate-nodule assessment test, is even more optimistic. “This is one of the few blockbuster markets that are out there in diagnostic medicine,” Luderer says. Assuming $3,000 per test for three quarters of a million indeterminate nodules per year, “it is potentially a $2bn market” in the US.

Summary of companies and their lung cancer diagnostic products featured in this article

Source: Medtech Insight

|

Company |

Test |

Modality |

Stage |

Comments |

|

Integrated Diagnostics, Inc. (Indi) |

XpresysLung |

Mass spectrometry measures circulating cancer-associated proteins in blood |

LDT through CLIA-certified company lab |

Management of indeterminate lung nodules |

|

VisionGate |

LuCED Lung Test using Cell-CT |

Proprietary imaging platform for epithelial cells from sputum, distinguishing healthy from cancerous cells |

Market entry planned as an LDT through a CLIA lab. Prospective FDA trial in 2017 |

Noninvasive. Potential to function as screening test as well as help manage indeterminate lung nodules |

|

Genesys Biolabs |

PAULA’s Test |

Analyzes protein biomarkers in blood, including three tumor antigens and one tumor autoantibody associated with lung cancer |

LDT through CLIA-certified company lab |

Early detection. Cost $118; company focused on Asian markets |

|

Breath Diagnostics, Inc. |

OneBreath |

Detection of four lung cancer-specific carbonyl compounds in breath |

Commencing FDA trials in 2017 |

Three projected indications: (1) Monitoring for recurrence post-resection (2) Evaluating indeterminate nodules (3): Early diagnosis in place of CT |

|

Owlstone Medical |

Respiration Collector for In Vitro Analysis (ReCIVA ) |

Detection of cancer metabolites in breath |

CE marked. UK’s NHS performing clinical trial |

For early detection as well as management of indeterminate nodules |

|

Veracyte |

Percepta Bronchial Genomic Classifier |

Genomic analysis of epithelial cells after bronchoscopy |

Launched in 2015. Regional Medicare coverage anticipated in January 2017. |

Management of indeterminate nodules |

|

Chronix Biomedical |

CNI Evaluation Test |

Measures chromosomal instability in cell-free DNA |

Test for lung cancer offered only at The London General Practice in UK. FDA treatment monitoring in 2017 |

Early detection |

|

Oncimmune |

EarlyCDT-Lung |

Measures the presence of tumor autoantibodies in the blood |

CE marked. Commercial since 2012. Undergoing clinical trials in UK |

Early detection |

Breath Tests For Early Detection

Owlstone Medical is leading the charge on breath analysis for early detection of lung cancer with the 3,000-patient LuCID study (Lung Cancer Indicator Detection) underway at 21 sites in the UK. (Also see "From Military To Medicine, Owlstone Medical Targets Lung Cancer With Its Breath Analysis Tech" - Medtech Insight, 3 Oct, 2016.). The company’s CE-marked ReCIVA test collects volatile organic compounds (VOCs) from the patient’s breath in a proprietary collection device, then analyzes them for evidence of early cancer with its microchip sensor technology called FAIMS (Field Asymmetric Ion Mobility Spectrometer). The LuCID study is collecting data to determine ReCIVA’s sensitivity and specificity.

In the race to develop a breath test, Owlstone had a key advantage: its parent company Owlstone Inc. originally built FAIMS to sniff out chemicals for military and security applications with $71m in funds. The company then reprogrammed its software to detect different chemicals for lung cancer, spinning out Owlstone Medical in March 2016. England’s National Health Service has funded the LuCID trial with £1.1m.

With an anticipated commercial release in 2017, the company is still working on regulatory approval, including in the UK and Europe.

Louisville, Kentucky-based Breath Diagnostics, Inc. is working on a breath-based strategy as well. Michael Bousamra, a Kentucky-based thoracic surgeon, co-founded the company in 2014, joined by University of Louisville chemical engineer Xiao-An Fu, who developed the company’s technology. OneBreath uses mass spectrometry to measure concentrations of four carbonyl compounds in a single breath—compounds that not only rise in the setting of lung cancer but also fall or even normalize again after treatment, a discovery Bousamra and Fu published in Annals of Thoracic Surgery in October 2016.

Though the ultimate aim is to replace CT as a screen for high-risk patients, the company hopes to first come to market as an CT adjunct for monitoring after cancer resection, with positive breath markers suggesting the need for a PET scan. Bousamra, who is also company president, is writing a grant for US FDA enabling studies, with hopes of commencing in January 2018.

A second proposed indication is to develop OneBreath as an FDA-approved means of evaluating indeterminate lung nodules on CT. A study published in September 2014’s Journal of Thoracic and Cardiovascular Surgery found that OneBreath outperformed PET scans for determining the malignancy of indeterminate pulmonary nodules.

“Especially in the Ohio River Valley, where histoplasmosis and other fungal etiologies are common, we have a lot of false positives on PET,” Bousamra says. “Our specificity was 77% and the PET scan specificity was 39%.” The company plans a multi-center pilot study for that indication."

“Breath analysis is a brave new world where [mass spec] companies are interested in expanding.” - Michael Bousamra, Breath Diagnostics, Inc.

Bousamra’s aim is to partner with a mass spectrometry company. “They’re our natural strategic partners in this business,” he says. “Breath analysis is a brave new world where [mass spec] companies are interested in expanding.”

Chromosomal Instability For Early Detection

San Jose-based Chronix Biomedical technology’s laboratory uses next-generation sequencing to analyze chromosomal instability of cfDNA in plasma, primarily to help direct medical procedures in patients with positive mammograms or elevated PSAs. (Also see "Liquid Biopsy In Oncology: An Increasingly Crowded Landscape" - Medtech Insight, 6 Sep, 2016.). But the company also offers a lung-cancer screening test to look for chromosomal gains and losses in ctDNA in high-risk smokers, generating a result called the copy number instability score (CNI). At present, the 2000 GBP screening test is offered only at London General Practice to help doctors decide whether to send certain high-risk smokers to imaging. The plan is to take a version of the test, Delta Dots, through a 510(k) FDA pathway in H1 2017. (Delta Dots predicts treatment outcomes after the first cycle of therapy.)

Immunological Approaches

Oncimmune Ltd. has been commercializing its immunoassay blood test, EarlyCDT-Lung, in the US since 2012. Its panel of tumor antigens allows for detection of circulating autoantibodies against tumor cells in the bloodstream, a signal that can rise for years before the cancer becomes symptomatic. (Also see "Oncimmune Set For Bigger US Push Of Early-Stage Lung Cancer Test" - Medtech Insight, 27 Oct, 2015.).

“We compliment CT by identifying a very high-risk group that will be suitable for CT screening. We can reduce tenfold the number of CTs to be done on patients,” says CEO Geoffrey Hamilton-Fairley.

As such, EarlyCDT-Lung is being tested as a pre-CT screening test in the UK. The NHS is currently conducting a trial of 12,210 high-risk patients to evaluate the test’s accuracy; those who test positive for tumor autoantibodies then receive LDCT screening.

“We compliment CT by identifying a very high-risk group that will be suitable for CT screening. We can reduce tenfold the number of CTs to be done on patients,” - Geoffrey Hamilton-Fairley, Oncimmune Ltd.

Interim data presented at December’s World Conference on Lung Cancer in Vienna, Austria showed that of 599 patients with positive test results, 16 had lung cancer, with 12 of those in an early stage. Final study results with two years’ CT follow-up will appear in 2019. EarlyCDT-Lung’s specificity is 93%. A future application of the test could be evaluation of indeterminate nodules, while a next-generation technology will allow healthy people to “bank” their autoantibody “fingerprint” in order to serve as their own control in a future test. The company plans to complete validation for the latter next year.

US Medicare part B reimburses at $124 for EarlyCDT-Lung. Total 2021 sales are projected to be $590m globally, including $275m in the US; these figures assume inclusion of a planned kit form of the test to be rolled out in H2 2017 (CE mark of the kit is anticipated in H1 2017). The company has 14 US distributors in place for its CLIA-certified Kansas lab.

A business unit of Rockville, Maryland-based 20/20 Gene Systems, [Genesys Biolabs] has a non-small cell lung cancer early-detection test on the market. PAULA’s Test is a laboratory-developed test (LDT) offered through primary care physicians for asymptomatic people aged 50 or older, who have smoked at least a pack a day for 20 years or longer. The company’s Maryland CLIA-certified lab analyzes a blood sample using a panel of biomarkers comprising three tumor antigens and one autoantibody. It then runs the results through a proprietary algorithm that takes some clinical factors into account and stratifies the patient into higher or lower-risk categories, offering guidance as to whether the patient should receive LDCT screening. Genesys reports that PAULA’s Test has a sensitivity of 74% with a specificity of 80% in the target population; about 99.3% of patients rated low-risk will indeed be cancer-free, while about 8.3% of high-risk patients will actually have cancer. A planned 2017 rollout of a next-generation test will have higher sensitivity and specificity, according to director of sales Barry Cohen.

Retailing at $118 plus shipping and handling, the test is not generally covered by US insurance companies, and Genesys plans to eventually convert to an FDA-approved kit model in the US. Cohen says the company is highly oriented to the Asian market: “We have found it to be much more receptive to our approach.” The venture arm of Chinese insurance giant Ping An Insurance (Group) Company of China, Ltd., holds a seat on the company’s board. Genesys also estimates a $3bn market in East Asian countries for a cloud-based consumer app to track annual cancer screening results, as biomarker screening is a widespread practice there, according to Cohen.

Genesys estimates a $3bn market in East Asian countries for a cloud-based consumer app to track annual cancer screening results, as biomarker screening is a widespread practice there.

The company’s next funding round, aimed at up to $21m, is anticipated to be a Series B or small IPO to close in February 2017, with half of investors likely from East Asia.

Proteomics For Nodules

Much as the PSA test seeks a single protein that may indicate prostate cancer, Integrated Diagnostics (Indi) offers a blood-based proteomic molecular diagnostic that detects multiple cancer-associated proteins. Xpresys Lung is a diagnostic adjunct to CT, identifying lung nodules likely to be benign to prevent an unnecessary workup. The company sees a $2bn US market in early lung cancer diagnosis.

Indi was founded in 2009 as a spinoff from the laboratory of Lee Hood, who was also founder of Amgen and Applied Biosystems.

Xpresys Lung, performed in Indi's CAP- and CLIA-accredited lab in Washington State, uses a technology Hood helped pioneer called multiple reaction monitoring mass spectrometry (MRM). This technique allows analysis of the proteome—hundreds of expressed proteins at a time—to find patterns betraying the presence of cancer.

In November 2015, a prospective multicenter study of 475 patients reported in Lung that the test may reduce by one-third the number of indeterminate nodules that go to surgery and are benign. A larger prospective multicenter study of patients with indeterminate nodules, including one-year CT follow-up, will be submitted for publication soon.

CEO and director Albert Luderer says that based on trial results, Indi is developing a second-generation test that uses just two protein analytes (down from 11 in the first test), and incorporates five clinical risk factors into the predictive model for lung nodules that are benign.

Indi is in talks with MolDx, a program of CMS contractor Palmetto GBA that evaluates molecular diagnostic tests for possible coverage and reimbursement. If a favorable determination is made, the company will launch a C round of financing (it raised $80m in previous rounds) to take Xpresys Lung through to commercialization, including establishing a registry and conducting an interventional clinical utility study. The goal is to launch to the public by the end of 2017.

Examining Cells To Understand Nodules

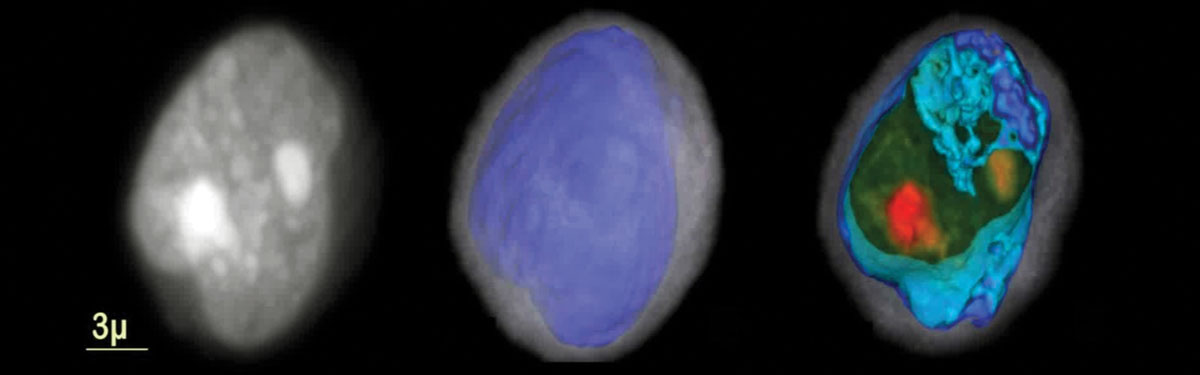

If you could see a lung epithelial cell and knew what to look for, you could tell by its appearance whether it was cancerous. Phoenix, Ariz.-based VisionGate’s LuCED test uses a noninvasive sputum sample and proprietary technology to do just that. Called Cell-CT, the platform creates 3-D tomographic images of cells coughed up in sputum. These images are so detailed that the cells’ morphology can be categorized according to 704 structural biomarkers; cancerous cells differ enough from healthy ones that they can be detected based on these morphologic differences.

VisionGate's LuCED test Cell-CT creates 3-D tomographic images of cells in coughed up sputum Source: VisionGate

In a nine-site study presented at WCLC in Vienna in December, LuCED was used to examine sputum samples from 60 high-risk but cancer-free people, and 79 with biopsy-confirmed cancers. The technology found the cancers with 90% sensitivity and 97% specificity.

The company is writing pre-submission documents and aims to begin FDA prospective trials in H2 2017, first studying the use of the technology for incidental nodules. Chief medical officer Javier Zulueta says the technology may in future also prove useful as an adjunct to LDCT screening to reduce false positives, and even in pre-LDCT screening for lung cancer. Though the company hasn’t priced LuCED, “our intent is to be cost-effective with LDCT,” says company president Scarlett Spring.

VisionGate was founded in 2001 by its current CEO Alan Nelson, a bioengineer with numerous patents and publications. Trinnovate Ventures, a unit of Blue Cross Blue Shield of Arizona, led a March 2016 $20m funding round, one the company plans to close by the end of this year.

Because Cell-CT can detect dysplastic (precancerous) as well as cancerous cells, VisionGate is exploring its potential role in the chemoprevention of lung cancer. It has a licensing agreement with the University of Colorado Cancer Center for the drug iloprost, which Center research with bronchoscopy has shown can reverse dysplasia. The use of noninvasive LuCED to monitor the preventive effects of iloprost is currently in Phase 2 trials.

Faced with an indeterminate nodule, some pulmonologists opt to perform a bronchoscopy. But sometimes bronchoscopy results, too, are unclear. Veracyte’sPercepta Bronchial Genomic Classifier collects lung epithelial cells from the mainstem bronchus during diagnostic bronchoscopy, then, in the face of an indeterminate bronchoscopy result, analyzes those cells to detect genomic changes, some of which suggest the presence of lung cancer.

“There are about 300,000 of these bronchoscopy procedures done today on patients with a nodule that’s being worked up for lung cancer. We believe that number is going to continue to grow,” says CEO Bonnie Anderson, “Unfortunately, if the bronchoscopy does not confirm cancer, it cannot rule cancer out. The false-negative rate can be quite high. That is where Percepta comes in.”

Veracyte puts the US market opportunity for its Percepta Bronchial Genomic Classifier at up to $525m.

Anderson added that the test does not require that physicians give up any elements of their diagnostic routine. “We’re not taking anything out of their hands that they’re using today—we’re enhancing it,” she says. “This is very fundamental to getting diagnostics accepted, adopted, and paid for.”

The company puts Percepta’s US market opportunity at up to $525m.

Headquartered in the Bay Area, Veracyte made its name with Afirma, a widely-covered test allowing for evaluation of thyroid nodules, and went public in 2013. It launched Percepta in April 2015 as a laboratory-developed test. The technology is based on a principle called field of injury, in which cells distant from a tumor may still display telltale genomic alterations.

A July 2015 New England Journal of Medicine paper reporting on two prospective studies of Percepta, AEGIS I and AEGIS II, reported a negative predictive value of 91% and when combined with bronchoscopy led to a cancer-detection sensitivity of 97%, compared to 75% sensitivity for bronchoscopy alone. Findings from an ongoing multicenter clinical utility study were reported at the October meeting of CHEST in Los Angeles; these included reduction by about one-third of invasive procedures in patients with a low or intermediate risk of lung cancer before their Percepta test.

In fall 2016, the company announced that multiple Medicare contractors had issued draft local coverage determinations for Percepta, which, after its likely finalization in January, will allow Medicare coverage for the test for nearly two-thirds of US Medicare beneficiaries.

In 2017, Anderson says, Veracyte plans to expand access to Percepta by stepping up marketing efforts. The company’s hope is for Percepta to be added to guidelines, becoming part of the standard of care. “We believe being able to remove 30% of invasive procedures when we have only been on the market a year and just now started to get coverage, is a really good early indication that the test should be successful,” she says.

Major Challenges For Diagnostics

No matter how promising their products, companies looking to commercialize early diagnostic tests face an unusually steep road.

“Why is this market under pressure? It takes a fantastic amount of money to be able to do this, and then the coverage decisions are not always predictable,” says Integrated Diagnostics CEO Luderer. “You’ve got to commit early to clinical trials when you just don’t know what the outcome’s going to be. So it’s very risky.”

Demonstrating that a screening test works requires clinical trials with huge numbers of patients, as the large-scale NHS studies of Oncimmune and Owlstone demonstrate. And in the US, at least, what diagnostic companies lack in regulatory headaches they may make up for in reimbursement struggles.

That’s in part because most of their tests are laboratory-developed tests, which don’t require FDA approval and are CLIA-regulated instead.

Not being FDA-regulated means no established codes and no guaranteed reimbursement. From a payor’s point of view, it can be difficult to untangle which diagnostics will be truly informative and which won’t, says Michael Liang, a Baird Capital partner and Integrated Diagnostics investor. Increasingly, payors want to see a test show up in clinical guidelines before they’ll cover it—but the time and money it takes to make it into guidelines can break a company.

“It takes so much work in terms of money and cost and time to get these coverage decisions, and even when you've done it right, the payors are slow to respond and give you the coverage,” Liang says. “It's been the biggest factor that has been limiting the industry.”

In October 2014, the FDA released a draft guidance document laying out its intention to bring LDTs under its regulatory aegis, but on Nov. 18, 2016, the agency announced it would delay the release of final guidance. (Also see "Republican Congress, Trump Policies May Seek To 'Undo' FDA Device Safety Guidances; LDT Plan First To Go" - Medtech Insight, 18 Nov, 2016.). Though some insiders dreaded the prospect of FDA regulation, others say they wouldn’t object and have designed their clinical trials to an FDA level of rigor.

Still, various mixtures of optimism, confidence in non-US markets, and a conviction that lung cancer patients deserve better is driving these companies forward. Insiders say there’s room for several good products in this space, and some believe the right tests could transform lung cancer care in a few years’ time.